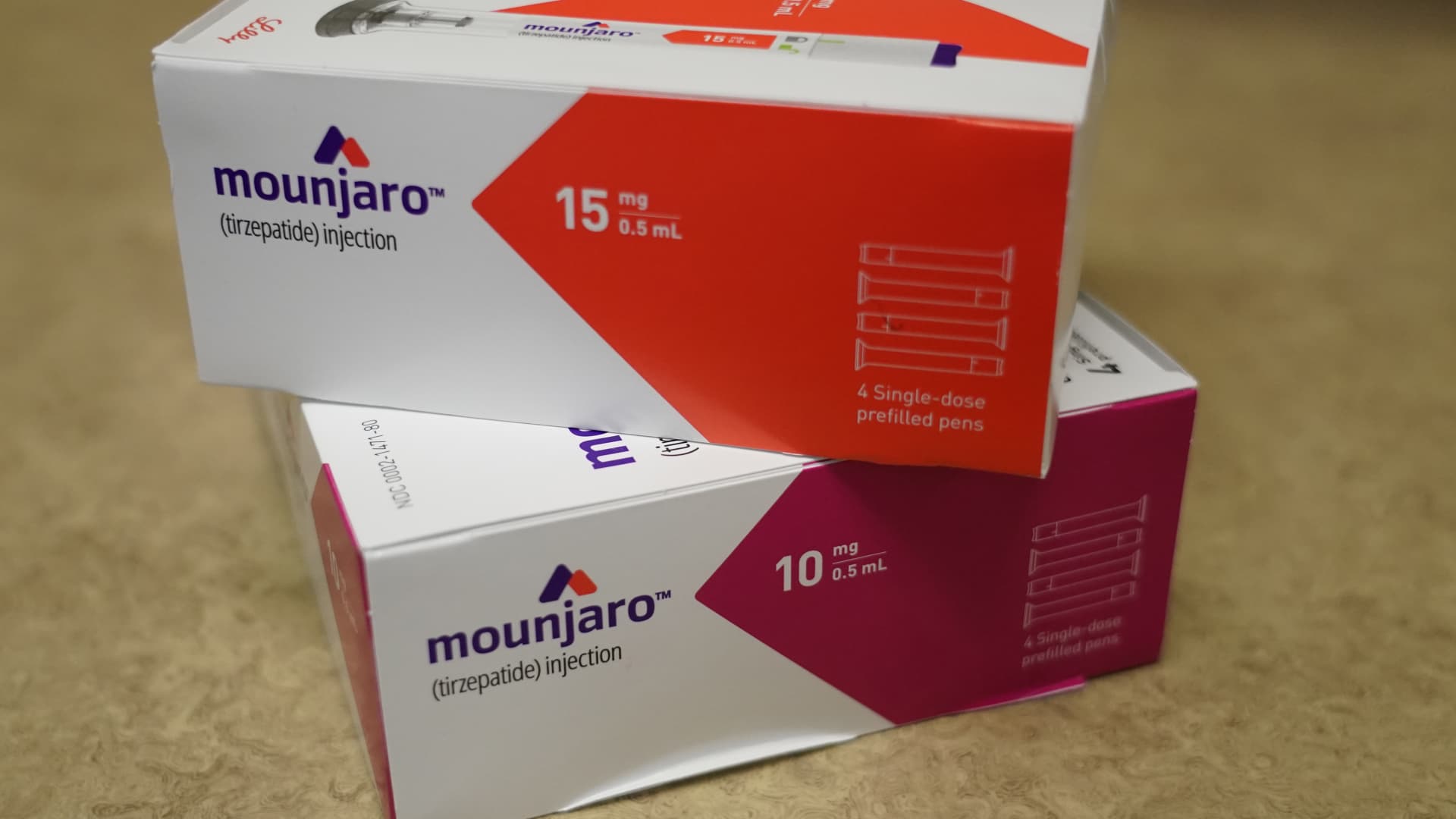

Eli Lilly ‘s presentation Tuesday evening at the influential JPMorgan Healthcare Conference was light on near-term financial updates, as expected, but heavy on discussion about the world’s most valuable drugmaker’s plans to sustain its recent run of successes well into the future. Investors liked what they heard and sent Lilly shares to an all-time high Wednesday. Eli Lilly intends to keep spending heavily, but wisely, on research and development in the coming years, CEO Dave Ricks said after the closing Tuesday, amid what Wall Street widely expects will be a period of blistering topline revenue growth fueled by tirzepatide — the active ingredient in its recently approved anti-obesity drug Zepbound and its 2022-cleared Mounjaro type-2 diabetes treatment. Shares of Lilly hit a record intraday high during Wednesday’s trading, above $637 each, before giving back some of the gains. Lilly, the eighth-most valuable company in the S & P 500 , briefly swelled to a market value of more than $600 billion for the first time ever. LLY 6M mountain Eli Lilly’s stock performance over the past six months. To help build a stellar drug pipeline that also includes next-generation obesity drugs and Alzheimer’s therapies, Eli Lilly has almost doubled its spending on research and development since 2018, reaching a projected $9 billion last year for a company expecting to generate $33.7 billion in revenue. “Our ambition is to grow [R & D] the way we have” but to do it in a deft way that yields new product breakthroughs, Ricks said. The focus will be on “a few big ideas” for patients with currently unmet needs, he said. “It seems unlikely we’re going to be able to grow rapidly by pursuing a lot of small ideas.” Ricks said that continuing to spend on R & D, which includes clinical trial costs, is necessary for Lilly to maintain the robust sales growth investors have come to expect from the company. Wall Street sees Eli Lilly’s revenue soaring to more than $66 billion in 2028, due in…

Read the full article here

Leave a Reply