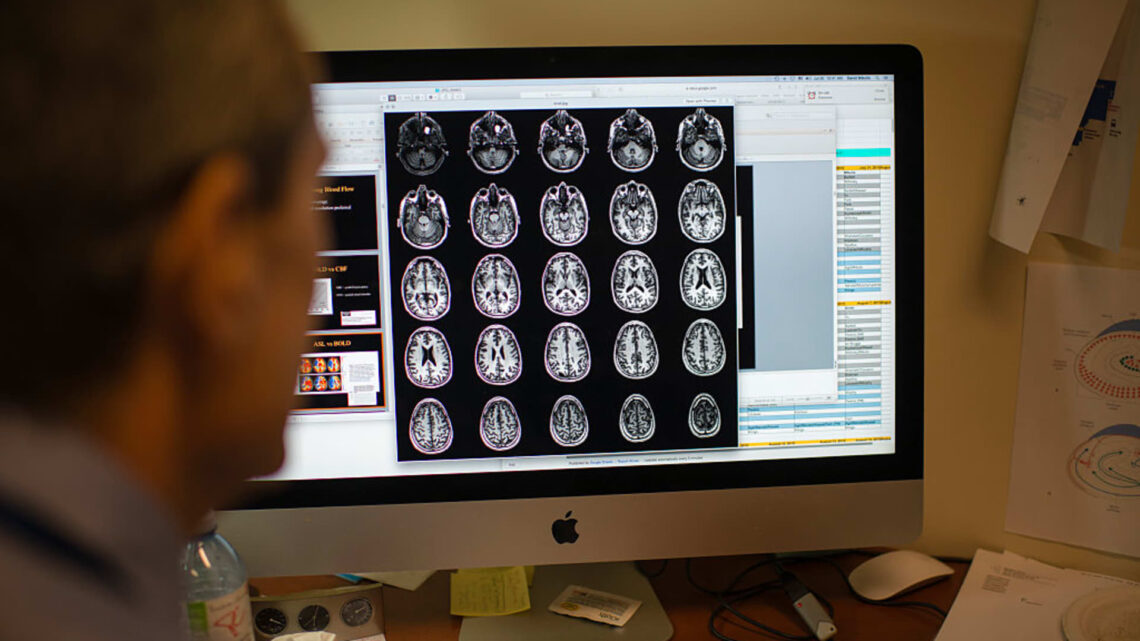

Club holding Eli Lilly is expecting to get approval for its Alzheimer’s treatment in the coming weeks, but investors looking for immediate financial success should temper their expectations. On its fourth-quarter earnings call Tuesday, rival drugmaker Biogen shared data that showed its therapy for the memory-robbing disease, Leqembi, is off to a slower-than-expected start. In short: Uptake of the drug, the first of its kind to receive full U.S. regulatory approval, has been limited by bottlenecks in the healthcare system including access to dementia specialists who can make an Alzheimer’s diagnosis. Eli Lilly’s experimental treatment — which is similar to Leqembi in the way it targets the disease and is administered to patients — is likely to face the same obstacles if cleared by the Food and Drug Administration despite its long-term promise. The FDA’s decision on Lilly’s drug, known as donanemab, is expected by the end of March. The latest update from Biogen underscores the challenges ahead for Lilly in making donanemab a commercial success. In the meantime, Eli Lilly’s diabetes and obesity drugs, the heart of our investment thesis, should continue to fuel the lion’s share of the company’s topline growth. About 2,000 patients are currently taking Leqembi, Biogen said Tuesday, up from 800 at the time of the company’s third-quarter report in November. Despite the progress, Biogen and its partner on the drug, Japan’s Eisai , are unlikely to reach their previous goal of 10,000 patients on Leqembi by the end of March. The Food and Drug Administration granted full approval to Leqembi in July , a milestone decision that enabled the U.S. government’s health insurance plan for seniors, Medicare, to provide reimbursement for the treatment. “We are clearly seeing that there is demand for the product,” Biogen CEO Chris Viehbacher said Tuesday. However, the challenge is converting people who want to be on Leqembi into recipients due to healthcare system bottlenecks. In…

Read the full article here