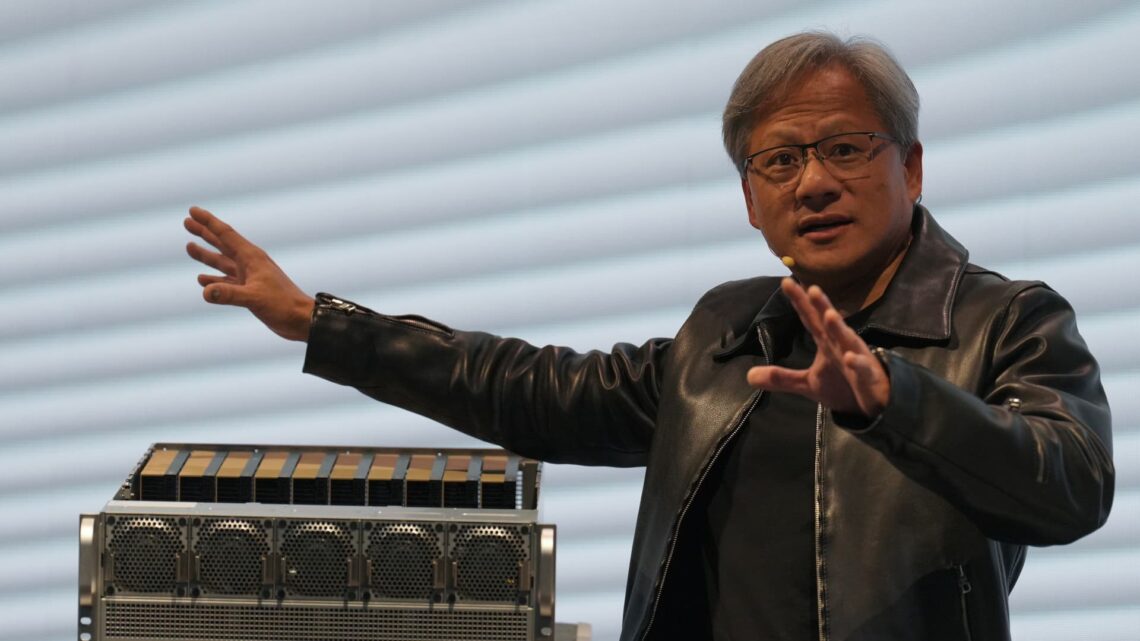

Nvidia CEO Jensen Huang speaks at the Supermicro keynote presentation during the Computex conference in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Images | Lightrocket | Getty Images

Investors have become so enamored with Nvidia’s artificial intelligence story that they want a piece of anything the chipmaker touches.

On Wednesday, Nvidia disclosed in a regulatory filing that it has stakes in a handful of public companies: Arm, SoundHound AI, Recursion Pharmaceuticals, Nano-X Imaging, and TuSimple.

With the exception of Arm, which topped $130 billion in market cap recently, shares of the Nvidia-backed companies soared Thursday following the 13F filing, a form that must be submitted by institutional investment managers overseeing at least $100 million in assets.

But none of these investments would be surprising to anyone who took the time to sift through old news reports and filings. The AI mania is firmly in an irrational exuberance phase, and investors are pouncing on anything and everything in the space.

No stock is hotter than Nvidia, which passed Amazon in market value Tuesday and then Alphabet on Wednesday to become the third-most-valuable company in the U.S., behind only Apple and Microsoft. Nvidia shares are up more than 200% over the past 12 months due to seemingly limitless demand for its AI chips, which underpin powerful AI models from Google, Amazon, OpenAI and others.

SoundHound, which uses AI to process speech and voice recognition, jumped 67% on Thursday, after Nvidia disclosed a stake that amounted to $3.7 million at the time of the filing. Nvidia invested in SoundHound in 2017 as part of a $75 million venture round.

SoundHound went public through a special purpose acquisition company in 2022, and Nvidia was named in its presentation as a strategic investor.

Nano-X uses AI in medical imaging. Nvidia’s disclosure of a $380,000 investment in the company sent the stock up 49% on Thursday. Nvidia’s involvement dates back years to a venture investment in…

Read the full article here