Almost three million New York households are dealing with housing costs that consume more than 30% of their household income, with 1 in 5 households experiencing a severe cost burden of more than 50% of their income going to pay for housing, according to a report by State Comptroller Thomas P. DiNapoli. This is the third report in the State Comptroller’s “New Yorkers in Need” series. Previous reports focused on poverty and food insecurity.

“For too many New Yorkers, finding and keeping an adequate and affordable place to live has become more and more difficult,” DiNapoli said. “Rising costs are stretching household budgets and forcing trade-offs with other essentials, like food and health care. The consequences of housing insecurity are wide-ranging and while low-income renters are the most cost-burdened, these financial pressures are increasingly felt by middle class households. Action is needed by all levels of government.”

Housing insecurity is defined as the absence of, or limited or uncertain availability of, safe, adequate and affordable housing. DiNapoli’s report examines three categories of housing insecurity: high housing costs; physical inadequacy, including overcrowding and substandard conditions; and housing stress, including evictions and foreclosures, which may result in homelessness.

Major findings include:

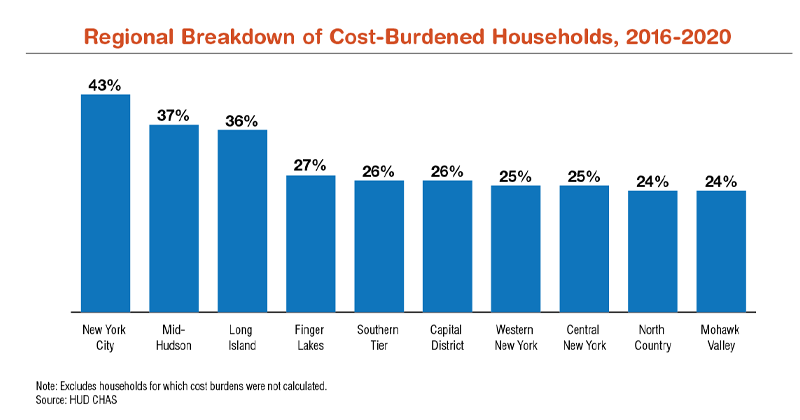

- Cost burdens are the main cause of housing insecurity: In 2022, New York had 2.9 million households paying 30% or more of their income for housing. This constituted 38.9% of households, the 3rd highest rate of housing cost burden among states.

- New York consistently ranks as one of the states with the highest cost burden for both owners (3rd in 2022) and renters (13th in 2022). The share of New York’s renters who are cost burdened (52.4%) is far greater than the share of cost-burdened homeowners (28%).

- Several factors affect cost burden, including the availability of housing at a variety of price points. Between 2012 and…

Read the full article here