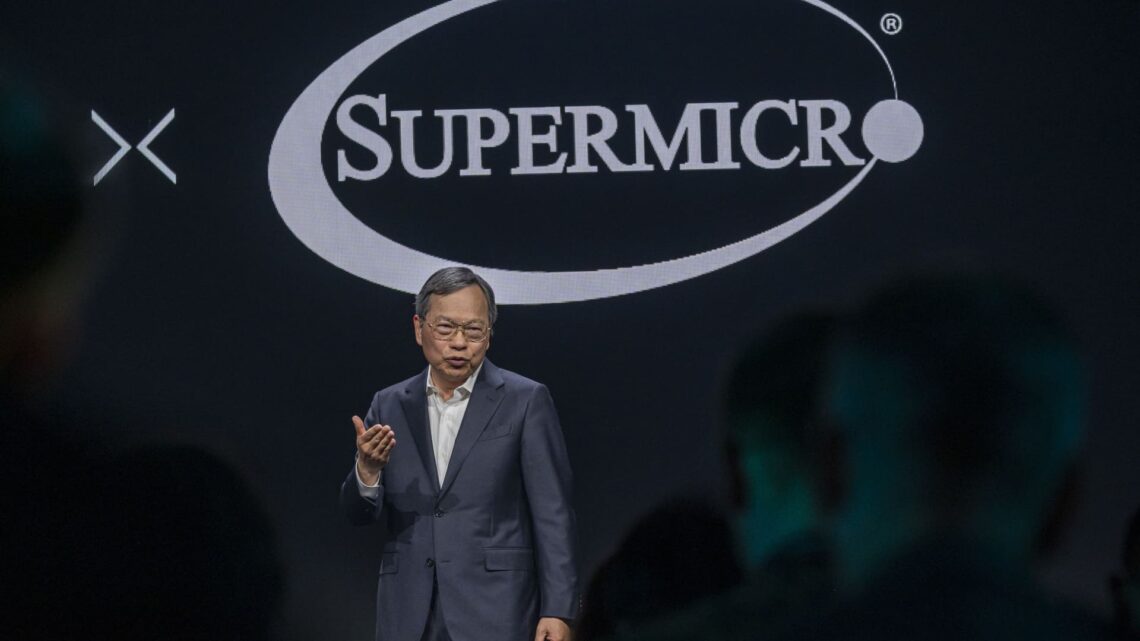

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. (We’re no longer recording the audio, so we can get this new written feature to members as quickly as possible.) Bracing for a decline? The market has been a bit sluggish for the last two sessions after reaching a record high on Friday. Even though the S & P 500 is only down a bit more than 1% from its all-time high, we have become more guarded due to the sudden and steep increases in certain stocks. This has led us to raise a caution flag, at least for the short term. Although some are claiming that the recent price surge in stocks with AI ties indicates an emerging bubble, we don’t think that’s the case. What we are warning about instead is some of the topping action that has formed. It’s important to differentiate between the two. “This is not bubbly, it’s toppy and there’s a very big difference,” Jim Cramer said. “People keep confusing them. We have pockets of worrisome action. The market is going to attack different areas of over-extension. The charts will develop right shoulders and people will fear the patterns.” For the uninitiated, “toppy” is financial slang for a stock market that climbs to new highs and then falls back. Bubbly, on the other hand, refers to a period when stock prices greatly exceed the fundamental value of their underlying companies. He added: “They will go after stocks like Super Micro , which continues to trade in erratic patterns. Celsius is totally nutty. They will go after Gitlab because it guided poorly. Take-Two Interactive is worrisome too. Target was down $5 yesterday and today it is up $19. Do you really need to pay up $19? Toppy, toppy, toppy.” If the market is indeed toppy, what could happen over the next few weeks is a shakeout of some of this excess froth. Healthy pullbacks happen every year, but feel horrible when going through them. The bright side…

Read the full article here