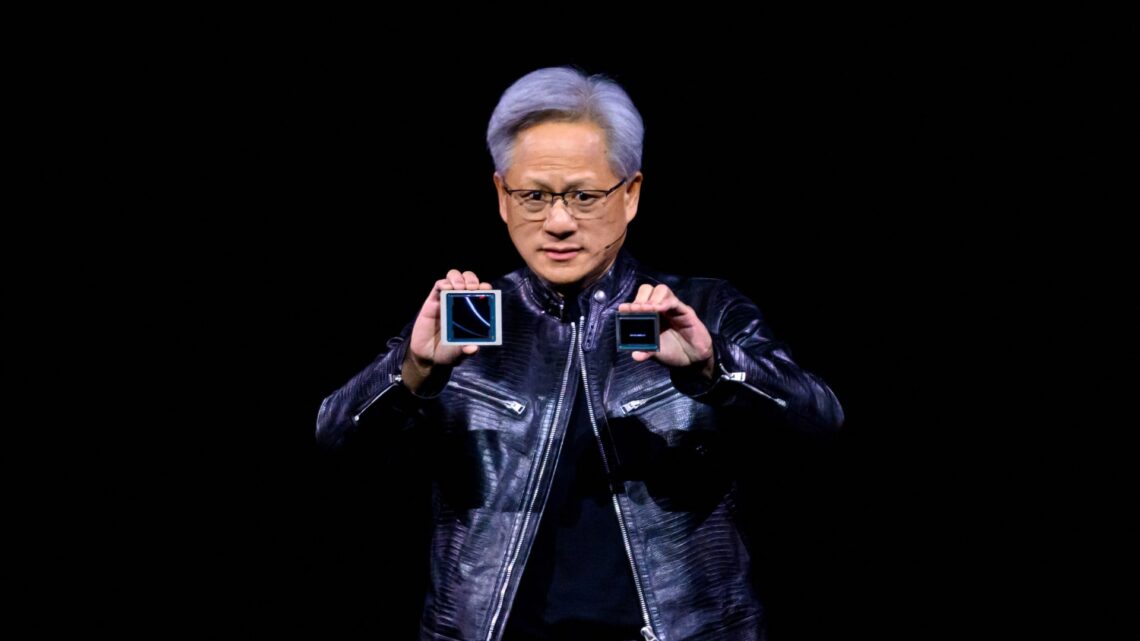

Nvidia founder and CEO Jensen Huang displays products onstage during the annual Nvidia GTC Conference at the SAP Center in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Images

Nvidia shares dipped 3% Tuesday morning after the company unveiled its new generation of artificial intelligence chips called Blackwell.

CEO Jensen Huang announced the new chips on Monday at Nvidia’s developers conference in San Jose, California, touting them as an even more powerful processor than the current generation of Hopper graphics processing units, which have been highly sought after for running large AI models. The first Blackwell chip is the GB200 and will ship later this year.

The company also announced a new enterprise software product known as Nvidia Inference Microservice, which makes it easier to run older generations of Nvidia GPUs.

“Move over Taylor Swift, you’re not the only one that can sell out a stadium as Jensen presented his GTC keynote to a packed crowd at the SAP Center in San Jose,” Bernstein analysts wrote in an investor note Tuesday, maintaining an outperform rating and $1,000 price target on the stock.

Wells Fargo analysts reacted to the chipmaker’s announcement with measured optimism, reiterating their overweight rating on Nvidia shares while boosting their price target to $970 from $840.

“While NVDA once again highlighted its full stack / platform differentiation, we think some may have anticipated a bit more out of the Blackwell B200 launch,” the analysts wrote in a note.

Still, the Wells Fargo analysts wrote the news reinforced their “long-standing positive thesis” on Nvidia’s technology and monetization opportunities.

Analysts at Goldman Sachs, retaining a buy rating of Nvidia stock, raised their price target to $1,000 from $875 on Tuesday and expressed “renewed appreciation” for Nvidia’s innovation, customer and partner relationships, and pivotal role in the generative AI space following the company’s keynote.

“Based on our recent industry…

Read the full article here