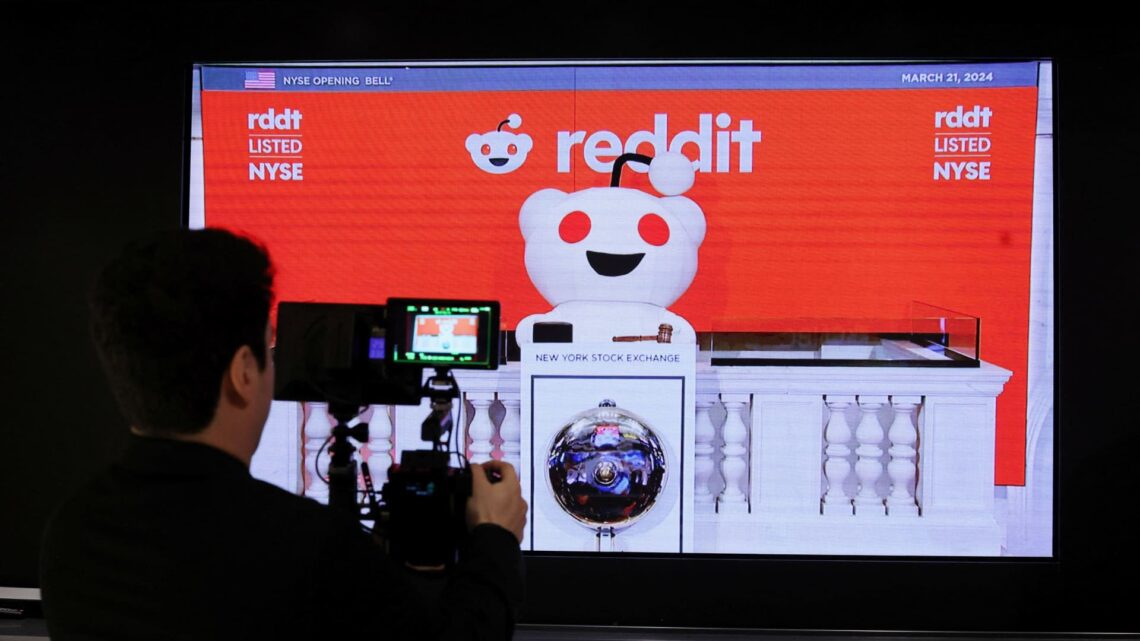

Reddit shares jumped as much as 70% in their debut on Thursday in the first initial public offering for a major social media company since Pinterest hit the market in 2019.

The 19-year-old website that hosts millions of online forums priced its IPO on Wednesday at $34 a share, the top of the expected range. Reddit and selling shareholders raised about $750 million from the offering, with the company collecting about $519 million.

The stock opened at $47 and reached a high of $57.80. At Thursday’s peak, the company had a market cap of about $10.9 billion. Reddit shares then dropped to $48.64 roughly half-an-hour after they began trading, giving the company a market cap of about $7.9 billion.

Trading under the ticker symbol “RDDT,” Reddit is testing investor appetite for new tech stocks after an extended dry spell for IPOs. Since the peak of the technology boom in late 2021, hardly any venture-backed tech companies have gone public and those that have — like Instacart and Klaviyo last year — have underwhelmed. On Wednesday, data center hardware company Astera Labs made its public market debut on Nasdaq and saw its shares soar 72%, underscoring investor excitement over businesses tied to the boom in artificial intelligence.

At its IPO price, Reddit was valued at about $6.5 billion, a haircut from the company’s private market valuation of $10 billion in 2021, which was a boom year for the tech industry. The mood changed in 2022, as rising interest rates and soaring inflation pushed investors out of high-risk assets. Startups responded by conducting layoffs, trimming their valuations and shifting their focus to profit over growth.

Reddit’s annual sales for 2023 rose 20% to $804 million from $666.7 million a year earlier, the company detailed in its prospectus. The company recorded a net loss of $90.8 million last year, narrower than its loss of $158.6 million in 2022.

Based on its revenue over the past four quarters, Reddit’s market cap at IPO gave it a price-to-sales…

Read the full article here