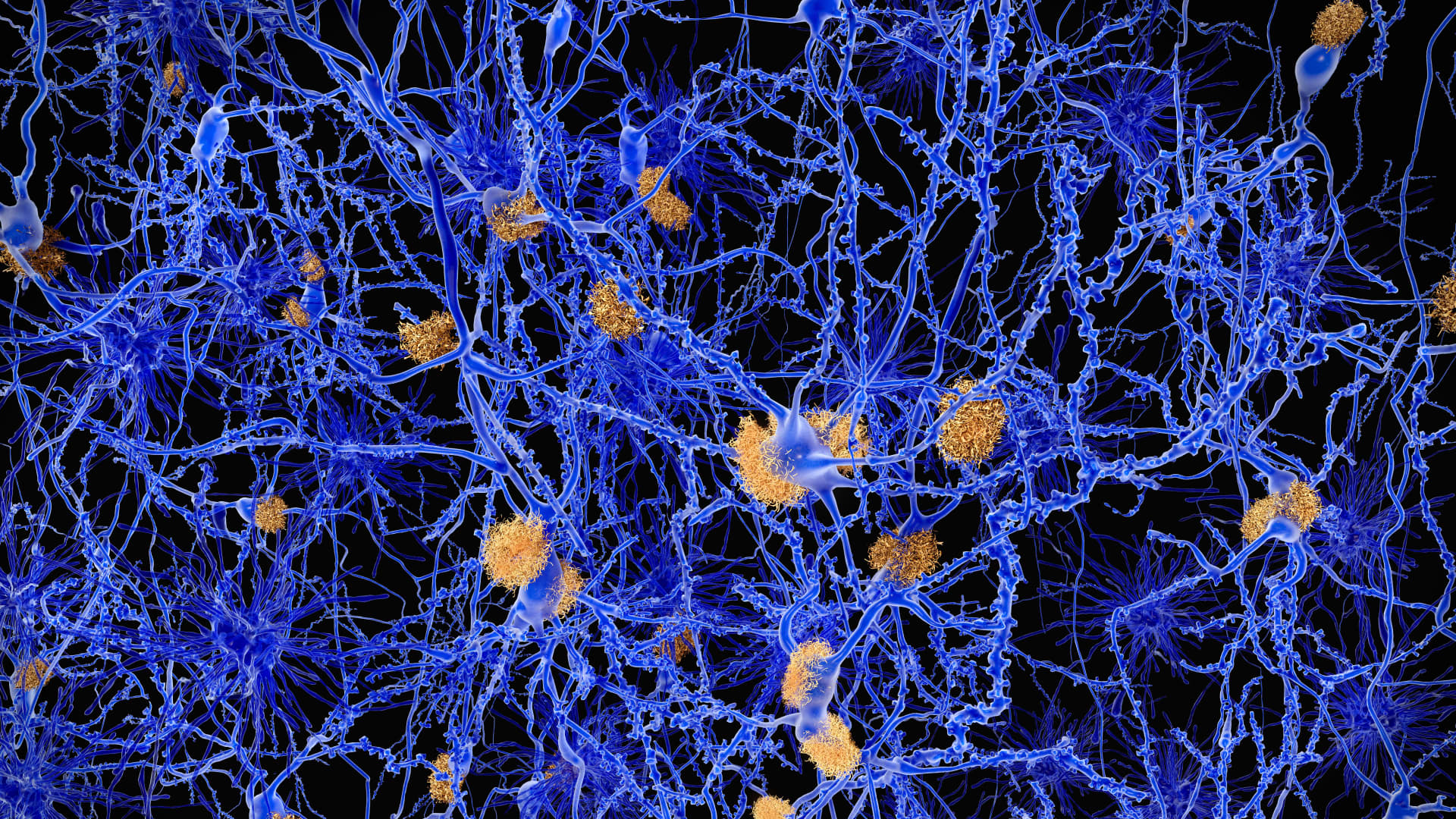

Positive developments for one of Eli Lilly ‘s (LLY) competitors in the nascent Alzheimer’s treatment market are good news for the Club name, too. However, a Wall Street bull has grown more cautious on Humana (HUM). Here’s a deeper look at the headlines and their implications for our investment theses in these two health-care companies. The news on Eli Lilly : The Food and Drug Administration granted full approval to Alzheimer’s treatment Leqembi, prompting the agency that administers Medicare to implement broader coverage for the expensive drug. Both actions, announced Thursday night, were widely expected on Wall Street. Nevertheless, they are important steps forward for the commercialization of Leqembi and similar Alzheimer’s treatments that may be cleared in the future, including Eli Lilly’s donanemab. Leqembi — developed by Japanese pharmaceutical firm Eisai and its Massachusetts-based partner Biogen (BIIB) — is the first anti-amyloid Alzheimer’s antibody to receive full FDA approval. Prior to Thursday’s announcement, U.S. regulators had only granted conditional clearance to Leqembi, which slowed cognitive decline in early-stage Alzheimer’s patients and people with mild cognitive impairment by 27% compared with a placebo over an 18-month trial. The drug’s side effects, which can be serious in some cases, include brain swelling and bleeding. This also marks the first time the Centers for Medicare & Medicaid Services (CMS) has agreed to broad reimbursement for this kind of Alzheimer’s treatment, which seeks to reduce build-up in the brain of amyloid beta, a protein linked to the memory-robbing disease. To be eligible for reimbursement, patients’ doctors must agree to submit data to a registry, which CMS says is designed “to study the usefulness of these drugs” outside a clinical trial for Medicare recipients. CMS’ coverage decision has been viewed as a critical step in Leqembi’s commercial success because its $26,500 list price puts it out of reach for many…

Read the full article here

Leave a Reply