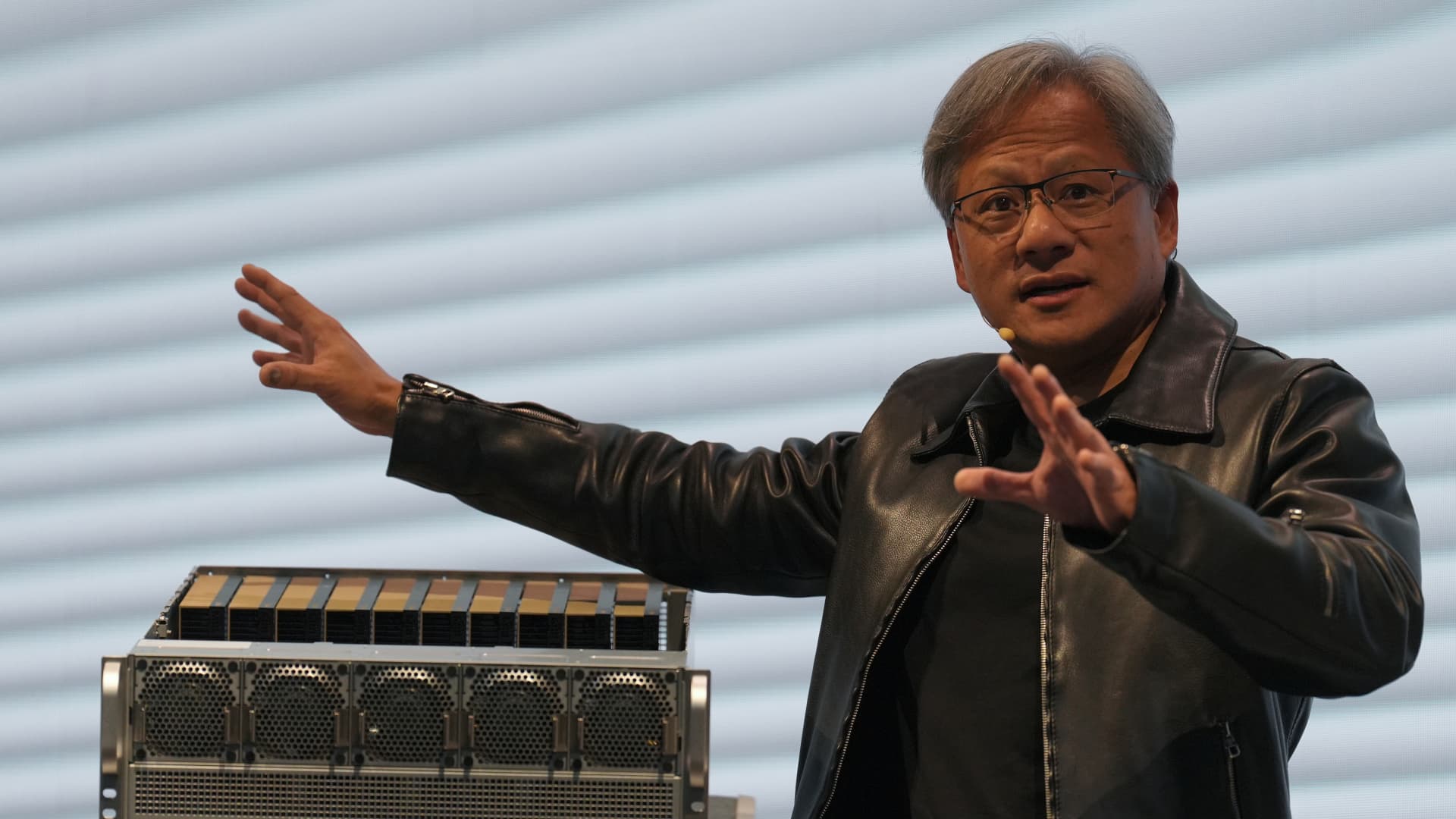

Good news for investors in Big Tech: The back half of this year is looking even better than the first. A review of analyst estimates for our mega-cap tech stocks — Nvidia (NVDA), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOGL) and Apple (AAPL) — shows strong earnings growth through the end of 2023. Collectively, these six long-term holdings are expected to boost profits by 87% in the second half, up from 27% in the first half, according to estimates from FactSet. Much of that optimism is driven by the market’s excitement with generative AI. But there are other factors at play, including better cost management, growth in key markets like the cloud and data center, and just plain innovation. And while all of these tech stocks have had big rallies this year, there’s likely still room to run. Consider: Based on calendar year 2024 earnings estimates, all six are trading at levels that are in line with their five-year forward price-to-earnings multiples. “We’re optimistic there could be further upside in the back half of the year based on their earnings potential and not simply multiple expansion,” said Zev Fima, portfolio analyst for the Investing Club. Here then are our six mega-cap tech stocks, ranked by the combined earnings growth rate for the upcoming two quarters (versus the year-ago period) — along with reasons for all the enthusiasm. Nvidia 1st half earnings growth: 103% 2nd half expected earnings growth: 371% Investor excitement in Nvidia, already high, was lifted even further by the company’s recently reported fiscal second quarter , which blew expectations out of the park. The chipmaker is benefiting from companies across industries racing to adopt generative AI using Nvidia’s state-of-the-art infrastructure. During the quarter, Nvidia saw massive demand from cloud service providers, enterprise IT and software providers for its NVIDIA H100 graphic processing units that power AI workloads. The exceptional results show Nvidia’s…

Read the full article here

Leave a Reply