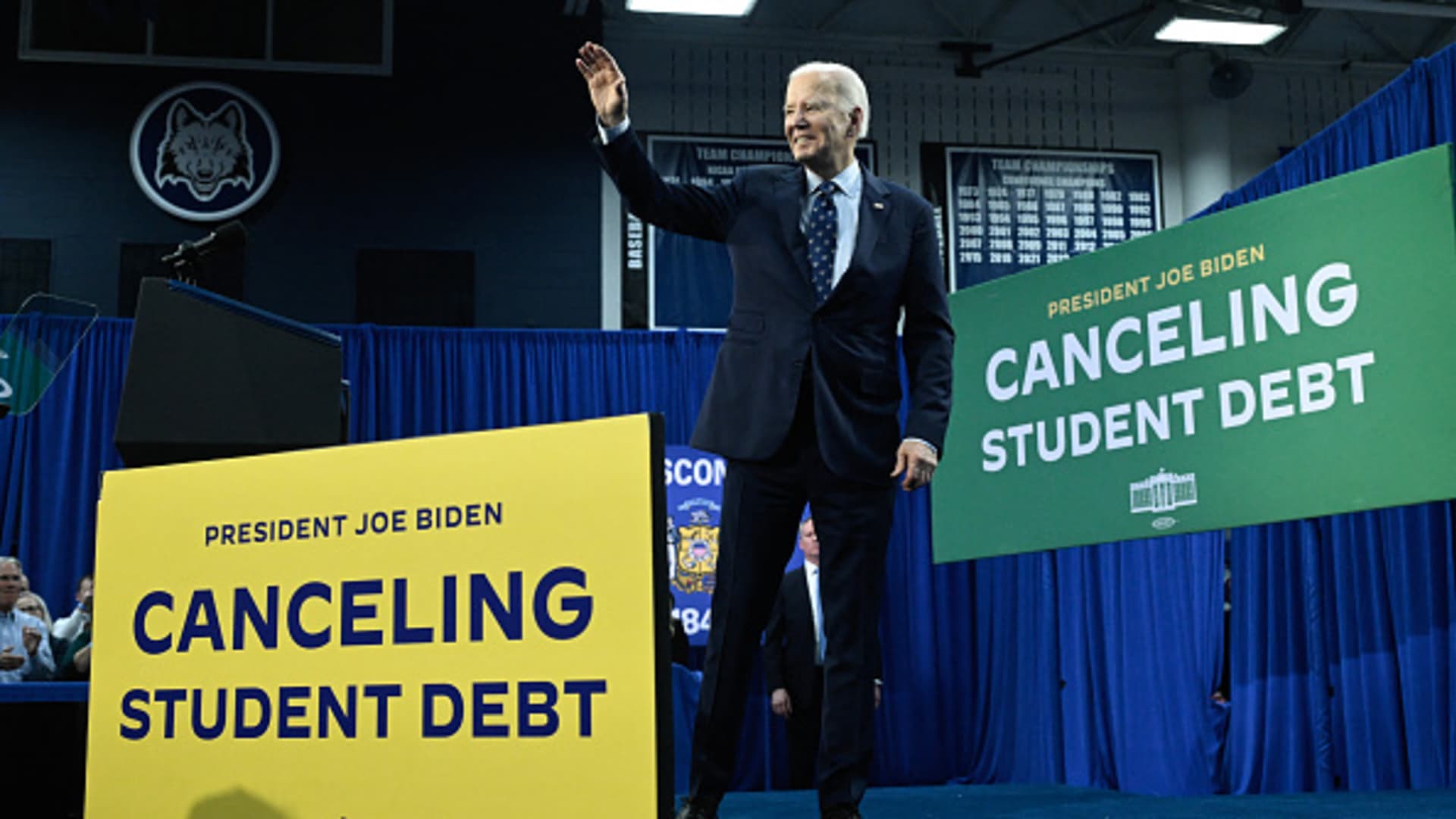

US President Joe Biden gestures after speaking about student loan debt relief at Madison Area Technical College in Madison, Wisconsin, April 8, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

Mishima Hughson filed for bankruptcy in December, joining the ranks of hundreds of thousands of Americans who undergo the process each year.

Along the way, the Roanoke, Virginia, resident also joined a much smaller group: Those who have managed to get their federal student loans erased in court. The U.S. Department of Education found that Hughson was no longer responsible for her $158,182 debt.

“I thought it was a joke,” Hughson, 58, said. “I was shocked.”

For decades, borrowers have found it next to impossible to walk away from their federal student debt in bankruptcy. Amid concerns that young people would try to ditch their obligations, policymakers made the bar for the discharge of student debt in court particularly high.

Some people needed to prove a “certainty of hopelessness,” and government lawyers battled most of the requests. Between 2011 and 2019, more than 99.8% of borrowers who filed for bankruptcy did not get their student loans discharged, U.S. lawmakers recently pointed out.

More from Personal Finance:

Mega backdoor Roth conversions can be a ‘no brainer’ for higher earners, expert says

Why a five-day return to office is unlikely, Stanford economist says

Here’s how ‘spaving’ could hurt your finances

That’s now changing.

In the fall of 2022, the U.S. Department of Education and the U.S. Department of Justice jointly released updated bankruptcy guidelines aimed at making the process for student loan borrowers less arduous. The Biden administration’s updated policy now treats student loans more like other types of debt in bankruptcy court, experts say.

“While the government used to fight discharge aggressively in almost every case, there is now a policy to agree when the borrower can show financial need and a history of good faith efforts to pay the loans,” said…

Read the full article here

Leave a Reply