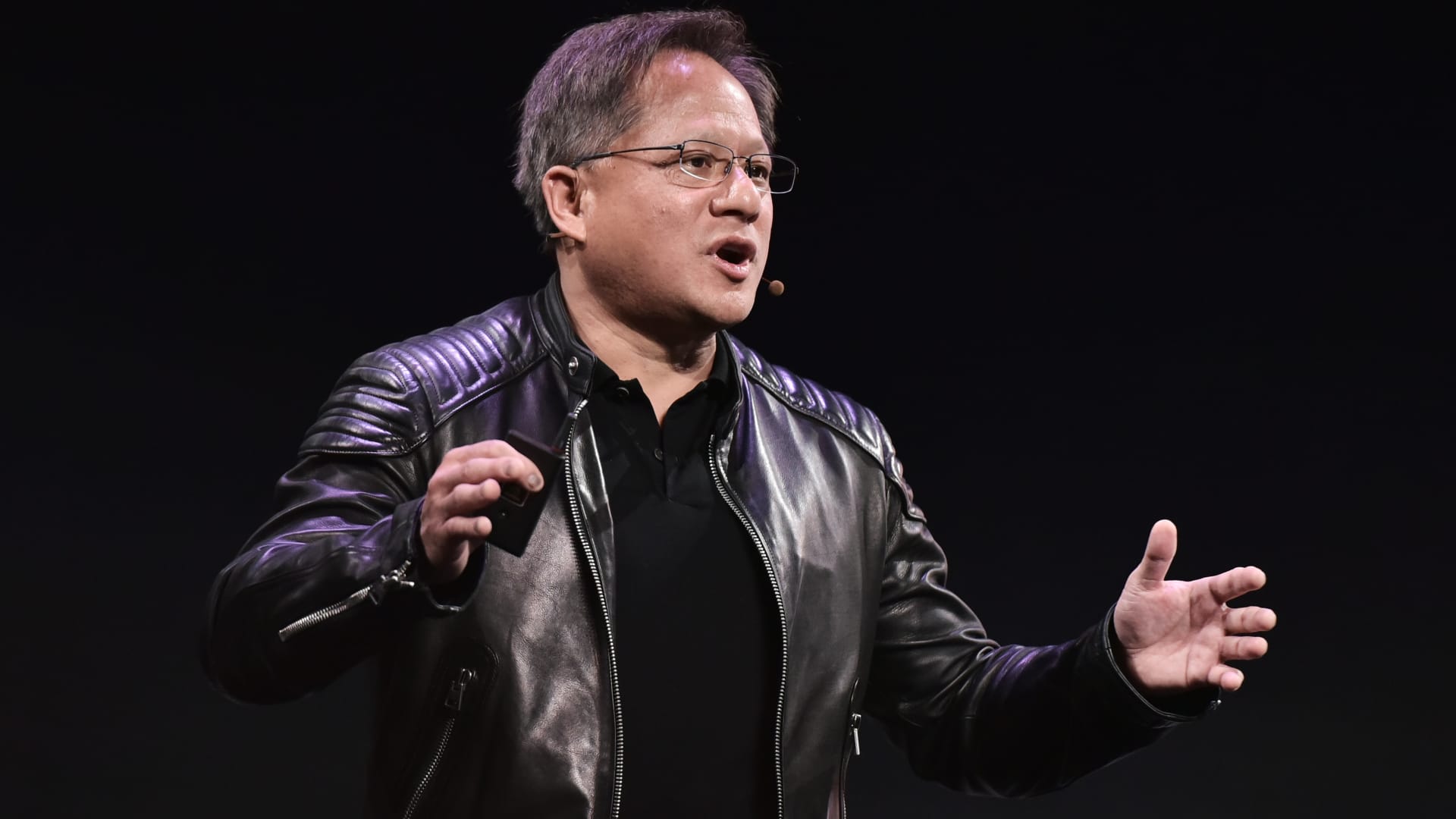

Nvidia (NVDA) has needed help from its Big Tech friends to become Wall Street’s artificial intelligence darling. Those friends haven’t left the party yet. In their earnings reports this week, Club holdings Microsoft (MSFT), Alphabet (GOOGL), Facebook-parent Meta Platforms (META) and Amazon (AMZN) indicated continued investments to advance their AI ambitions — a good sign for Nvidia. All four companies are buyers of Nvidia’s cutting-edge AI chips, which dominate the market for training the massive models that power applications like the viral ChatGPT. Investors will hear directly from Nvidia in late November when the Jensen Huang-led company releases quarterly earnings. “I think that Nvidia is the quiet partner behind the winners including Microsoft,” Jim Cramer said Friday. “Not saying it will be the best [quarter], just saying it is best positioned.” The encouraging signs for Nvidia come as the chipmaker grapples with the U.S. government’s new curbs on AI chip exports to China, weighing on investor sentiment and its stock price since the restrictions were announced early last week. Fervent demand for Nvidia’s chips in the rest of the world should make up for lost China sales in the short run, the company has said. However, the primary worry for investors — including here at the Club — is whether a substantially diminished China opportunity will prevent Nvidia from meeting The Street’s loftiest long-term growth projections. While Nvidia has, by far, been the best-performing stock in our portfolio this year with a gain of roughly 175%, it has dropped 20% since its all-time high of $502.66 back in late August. NVDA YTD mountain Nvidia YTD Nevertheless, the earnings reports and commentary from Microsoft, Google-parent Alphabet, Meta and Amazon help illustrate why Nvidia has repeatedly been able to downplay the near-term financial impact of Washington’s export controls. Spending by U.S. tech giants on AI infrastructure is soaring, and orders for Nvidia’s…

Read the full article here

Leave a Reply