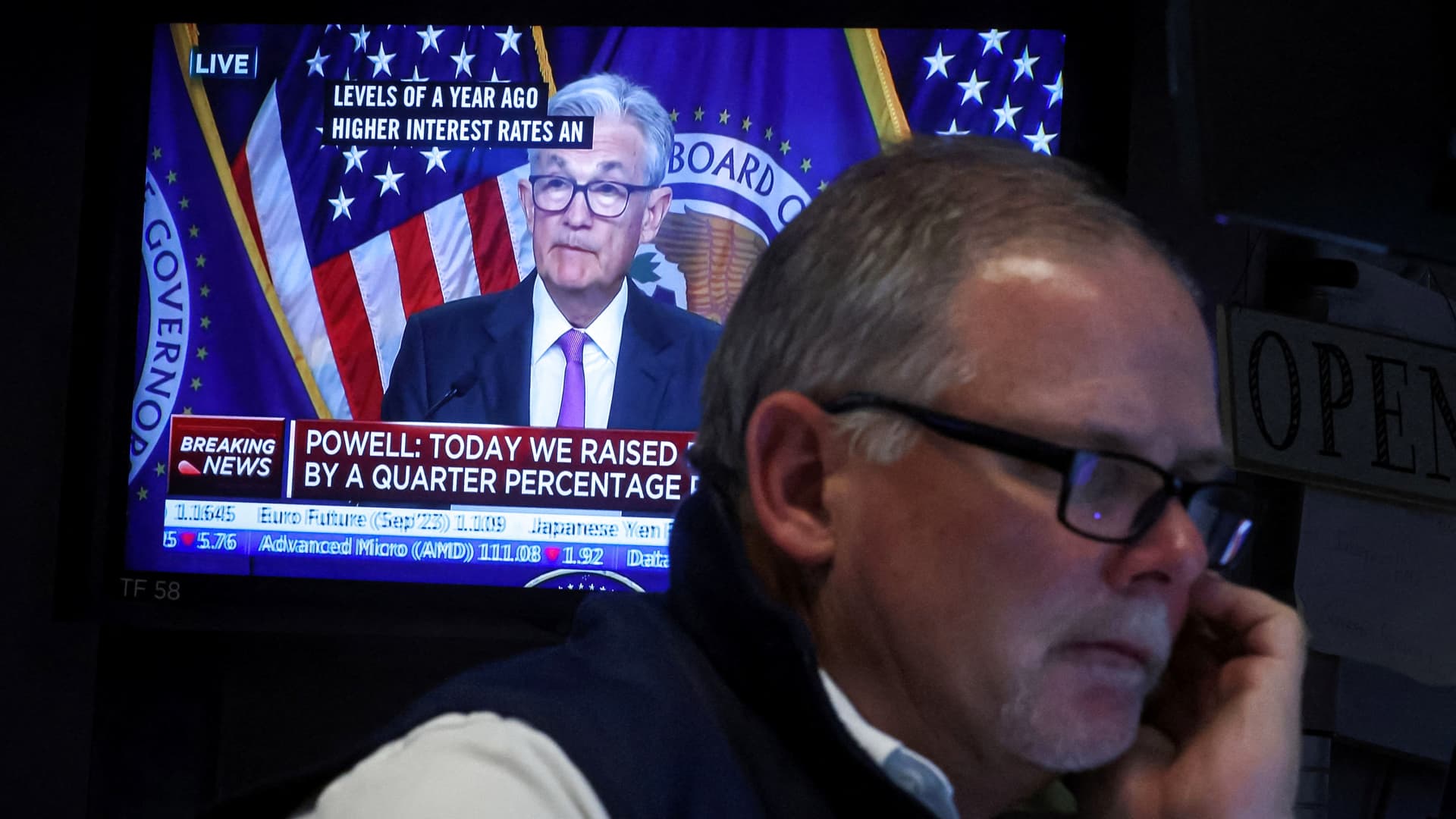

A trader works, as a screen displays a news conference by Federal Reserve Board Chairman Jerome Powell following the Fed rate announcement, on the floor of the New York Stock Exchange (NYSE) in New York City, July 26, 2023.

Brendan McDermid | Reuters

The world’s major central banks paused their interest rate hiking cycles in recent weeks and with data suggesting economies are softening, markets are turning their attention to the first round of cuts.

The U.S. Federal Reserve, European Central Bank and the Bank of England dramatically hiked rates over the last 18 months in a bid to tame runaway inflation.

The Fed on Wednesday held benchmark interest rates steady at a target range of 5.25%-5.5% for the second consecutive meeting after ending a string of 11 hikes in September.

Though Chairman Jerome Powell has been keen to reiterate that the Fed’s work on inflation is not yet done, the annual rise in the consumer price index (CPI) came in at 3.7% in September, down from a pandemic-era peak of 9.1% in June 2022.

Yet despite Powell’s refusal to close the door on further hikes in order to finish the job on inflation, markets interpreted the central bank’s tone as a slightly dovish pivot and rallied on the back of the decision.

The market is now narrowly pricing a first 25 basis point cut from the Fed on May 1, 2024, according to CME Group’s FedWatch tool, with 100 basis points of cuts now expected by the end of next year.

Since last week’s decision, U.S. nonfarm payrolls came in softer than expected for October, with job creation below trend, unemployment rising slightly and a further deceleration in wages. Although headline inflation remained unchanged at 3.7% annually from August to September, the core figure came down to 4.1%, having roughly halved over the last 12 months.

“Core PCE, which is the Fed’s preferred inflation metric, is even lower at 2.5% (3-month, annualized),” noted analysts at DBRS Morningstar.

“The lagged effects of a cooler housing market should reinforce…

Read the full article here

Leave a Reply