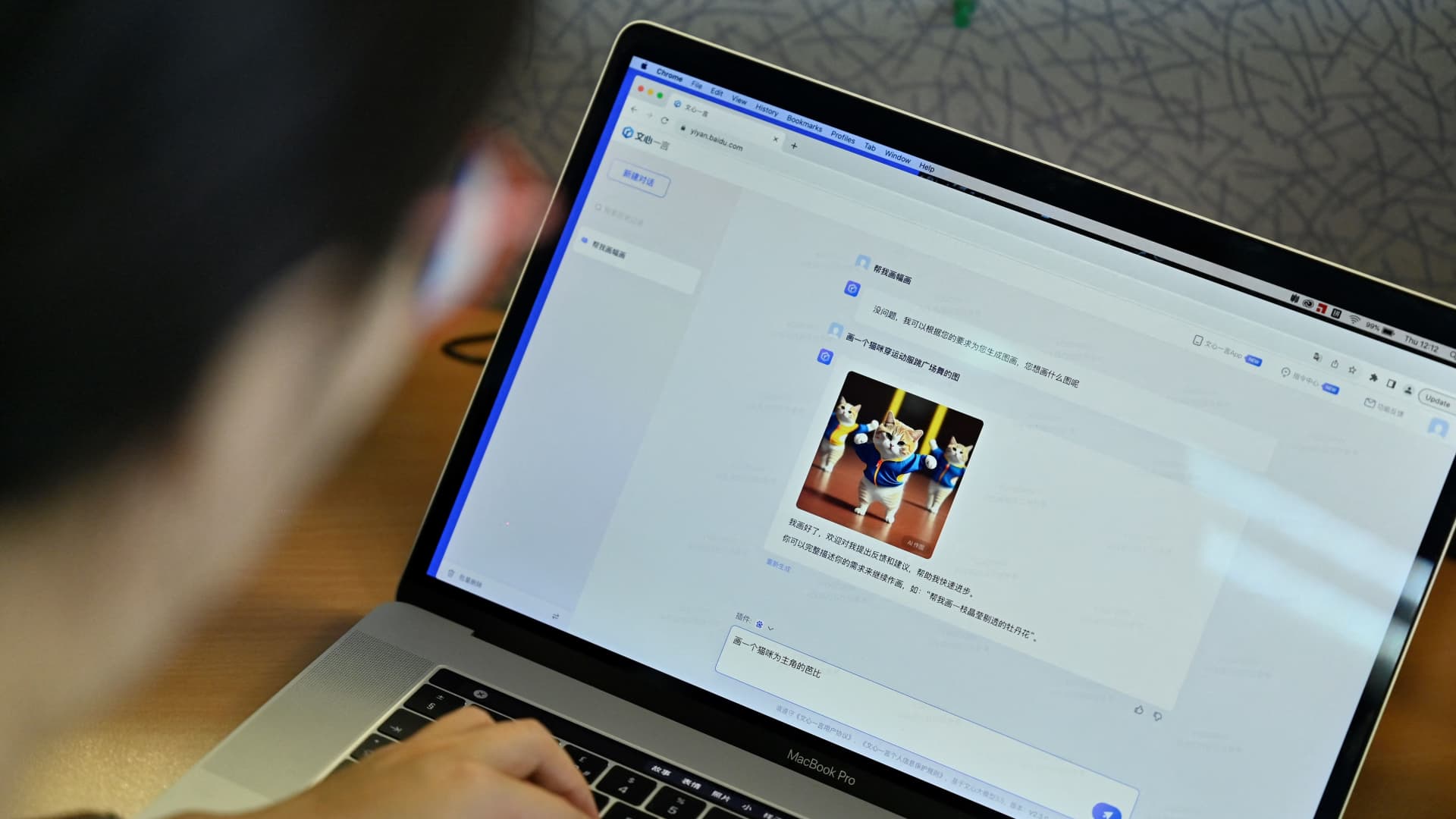

Chinese artificial intelligence stocks are surging, even if the broader market recovery remains more muted. OpenAI’s Sora text-to-video product reveal came towards the end of China’s Lunar New Year holiday. Locals rushed to discuss and share the tech’s possibilities online, and when markets reopened on Feb. 19, AI-related stocks took off. Wind Information, the equivalent of the Bloomberg terminal in China, even launched a Sora concept stock index of mainland China A shares that rose more than 20% in a week. Other Wind AI-related indexes saw similar gains in the last several days. Now in the week ahead, tech giant Baidu — which Morgan Stanley calls the “best AI play in China Internet” — is set to release earnings. The investment analyst team led by Gary Yu has a $140 price target and overweight rating on Baidu’s U.S.-listed shares. That’s more than 25% above where Baidu closed Thursday. Yu pointed out how Baidu is integrating its ChatGPT-like Ernie chatbot with Samsung’s new Galaxy S24 smartphones , and has a strategic collaboration with Honor , a smartphone brand spun off from Huawei. “We believe the current AI cloud integration between Galaxy AI and Ernie is just the first step,” Yu said. “Though current monetization scale could be limited, we expect there could be further expansion into other phone models, or potential development into an edge AI model in the long run, which is an untapped market as of now (i.e., processing of data and algorithms directly from an endpoint device without an Internet connection).” Baidu is set Wednesday before the U.S. market open to release results for the last three months of 2023. The company operates a range of tech businesses, including a search engine, cloud services and robotaxis. The macro environment of slower growth in China is a headwind for Baidu’s core ads business, while regulators keep a close eye on AI. That’s not stopping businesses from giving AI tools a try. Checks by Benchmark analysts led by Fawne Jiang…

Read the full article here

Leave a Reply