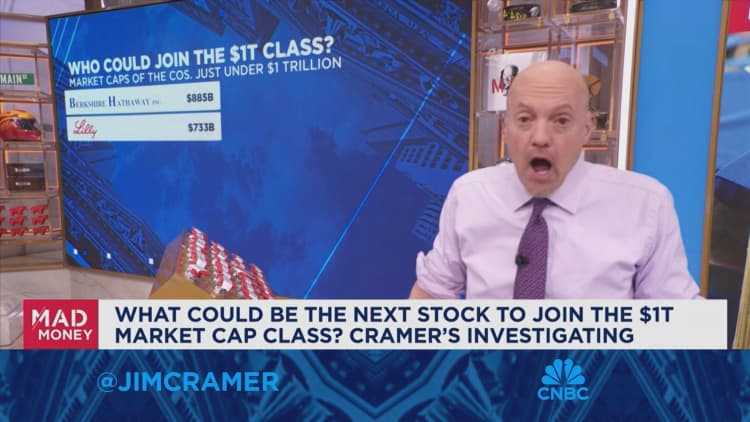

In the wake of Nvidia‘s rapid ascension, CNBC’s Jim Cramer on Monday picked companies he thinks could have a chance at breaking $1 trillion in market capitalization.

“There is no next Nvidia — it’s what we call at law school sui generis — and you might not see another story this strong for a generation,” he said, but added that there are other companies “that can break through the $1 trillion barrier, and while they’re not as exciting as Nvidia, a few of them come pretty darned close.”

Valued at a little more than $730 billion according to FactSet, drug maker Eli Lilly is Cramer’s top contender. To him, Eli Lilly will be propelled higher when insurance companies and investors realize the full potential of GLP-1 drugs, which are currently used to treat obesity and diabetes. There is also research to suggest these medications may be effective in treating cardiovascular and liver ailments.

Eli Lilly is the second-largest stock outside of the “Magnificent Seven.” At $905 billion, Berkshire Hathaway comes in first and Tesla, which is worth a little more than $611 billion, comes in third, according to FactSet.

To Cramer, “the continual and shocking rise” in the cost of auto insurance could push Warren Buffet’s company over the edge, but while Tesla could be worth more once it releases its new models, he said he thinks it’s less likely to reach $1 trillion.

Broadcom, which is currently worth about $606 billion according to FactSet, has potential because of its enterprising CEO Hock Tan, who Cramer said is adept at making acquisitions.

“My fear is that this partner of Nvidia could never be more than that,” he said. “If that’s the case, Nvidia might need to crack the $5 trillion mark before Broadcom crosses the $1 trillion threshold.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Nvidia, Eli Lilly and Broadcom.

Questions for…

Read the full article here

Leave a Reply