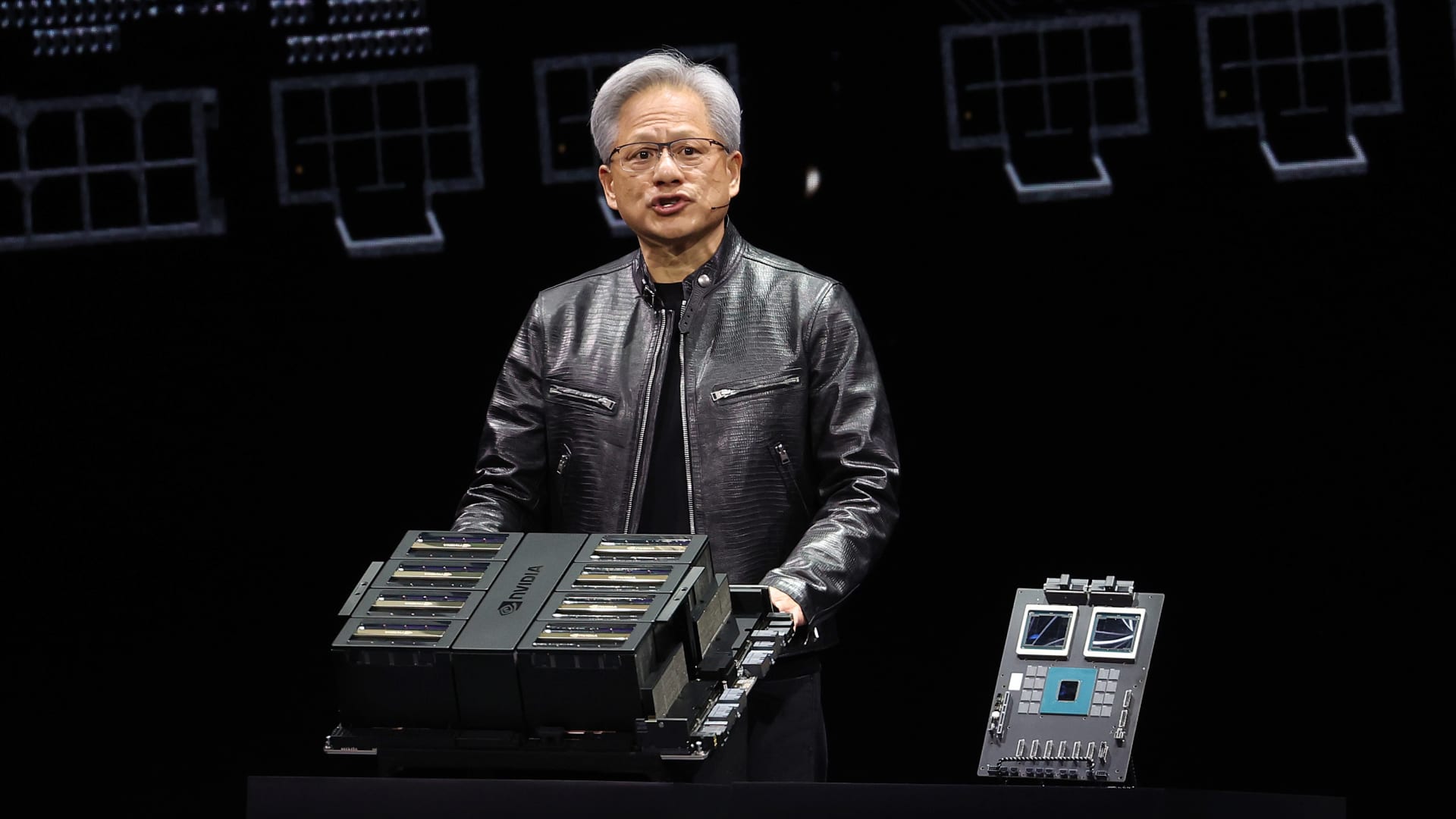

When Nvidia CEO Jensen Huang took the stage Monday at the chipmaker’s hyped-up artificial intelligence conference, he joked to the thousands of attendees packed into the arena that this was “not a concert.” In a literal sense, Huang was right. But that didn’t stop him from using his two-hour keynote address to cement Nvidia’s status as the generative AI bandleader, delivering hardware and software product announcements, including its anticipated next-generation Blackwell AI chip — and presenting why the chipmaker has become so dominant in the AI market. To our ears, Nvidia’s loudest instrument Monday was its growing lineup of software offerings, which is central to our confidence in this “own it, don’t trade it” stock. That designation used to belong to only Apple , a company Nvidia has taken a page from. Just as Apple has become a company driven by its software and hardware paired together to create an ecosystem, Nvidia is in the midst of a similar transformation. Huang’s keynote speech at the long-awaited GTC conference made that clear. “It’s not just a chip. It is a platform. Now what does that mean? It means it’s filled with software. What does that mean? It’s recurring revenue; it’s not one-off,” Jim Cramer said Tuesday. “You get into [Nvidia’s] ecosystem; you stay in their ecosystem. There are a lot of people who say it’s a defensive move. I say it’s an offensive move.” Shares of Nvidia rose about 0.4% Tuesday afternoon, to around $888 apiece, shaking off earlier losses in the session. NVDA 1Y mountain Nvidia’s stock performance over the past 12 months. The latest step in the chipmaker’s journey beyond hardware is the introduction of Nvidia Inference Microservices. So-called NIMs are prebuilt software packages that developers can use to speed up the development timeline for AI applications, such as copilot tools, using their companies’ data and compute infrastructure. NIMs will be included in Nvidia’s software subscription for businesses, called AI…

Read the full article here

Leave a Reply