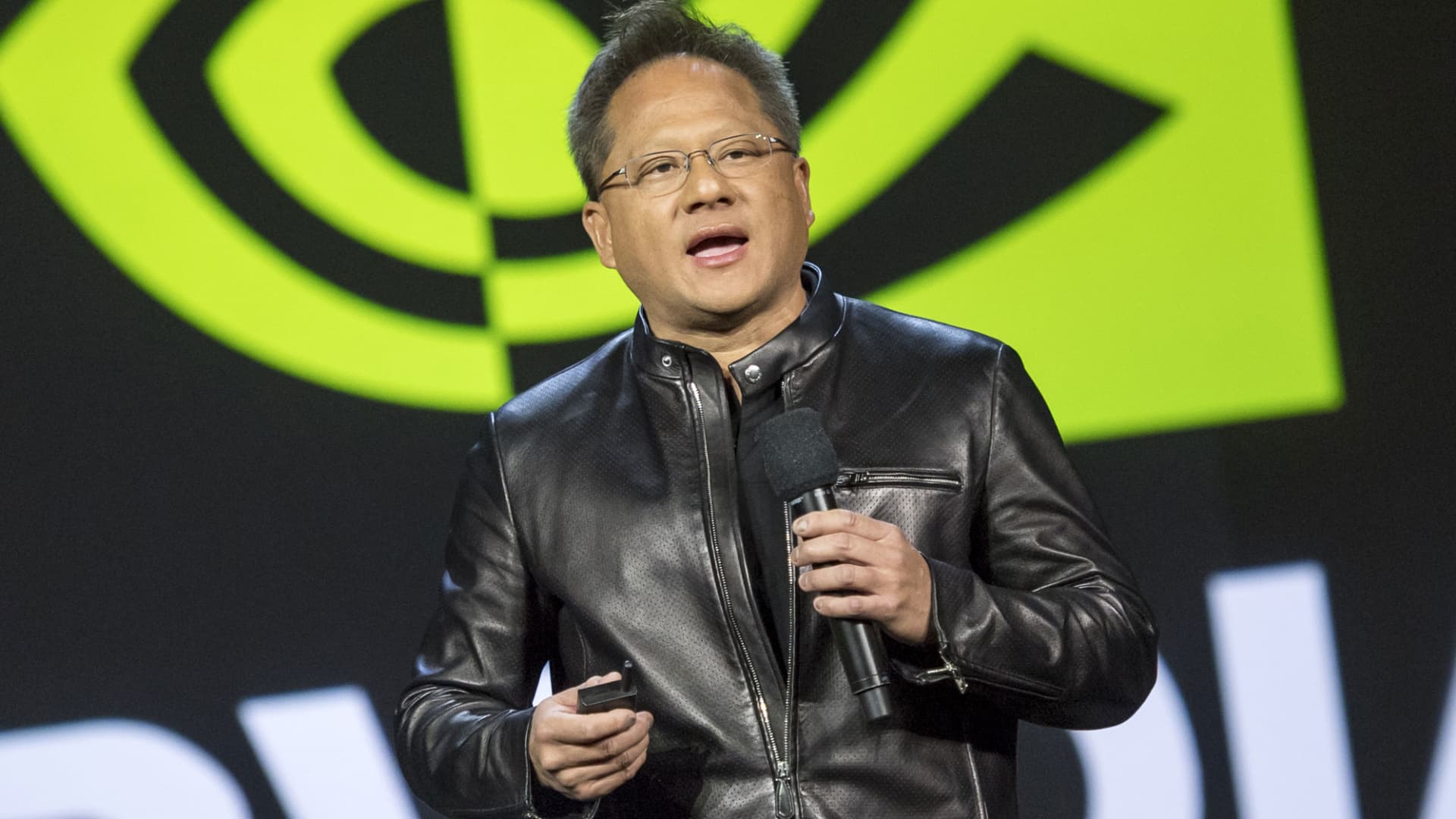

Jen-Hsun Huang, CEO, Nvidia.

David Paul Morris | Bloomberg | Getty Images

Check out the companies making headlines in the premarket.

Nvidia — The chipmaker popped 7% after reporting another blowout quarter that topped Wall Street’s estimates. Nvidia also offered optimistic guidance, saying sales will jump 170% during the current period as demand for artificial intelligence chips continues to gain steam. Adjusted earnings came in at $2.70 per share, ahead of the $2.09 estimate expected from analysts polled by Refinitiv. Nvidia reported revenue of $13.51 billion, topping the $11.22 billion expected by Wall Street.

Taiwan Semiconductor, AMD, Marvell Technology — Semiconductor stocks tied to artificial intelligence and Nvidia rose in the premarket on the back of another strong earnings report from the AI chip giant. Advanced Micro Devices, Marvell Technology and U.S.-listed shares of Taiwan Semiconductor rose 2.3%, 4.2% and 3.1%, respectively. Broadcom and Super Micro Computer added 3.4% and 8.5%, respectively.

Boeing — Shares lost about 2% before the bell after Boeing revealed a new manufacturing defect involving supplier Spirit AeroSystems that will delay 737 Max deliveries. The company said fastener holes were improperly drilled on some of the model’s aft pressure bulkheads. Spirit AeroSystems shed more than 6%.

Splunk — The stock gained 13.6% after Splunk reported an earnings beat. The cloud services provider earned 71 cents per share, after adjustments, on $910.6 million in revenue for the second quarter. Analysts surveyed by FactSet had expected Splunk would earn 46 cents per share and $889.3 million in revenue. The company also raised its guidance.

Snowflake — Shares of the cloud company jumped 3.5% on the back of its earnings report. Snowflake posted 22 cents in adjusted earnings per share on $674 million in revenue. Analysts polled by Refinitiv had estimated 10 cents in earnings per share on $662 million in revenue.

Dollar Tree — The discount retailer’s…

Read the full article here

Leave a Reply