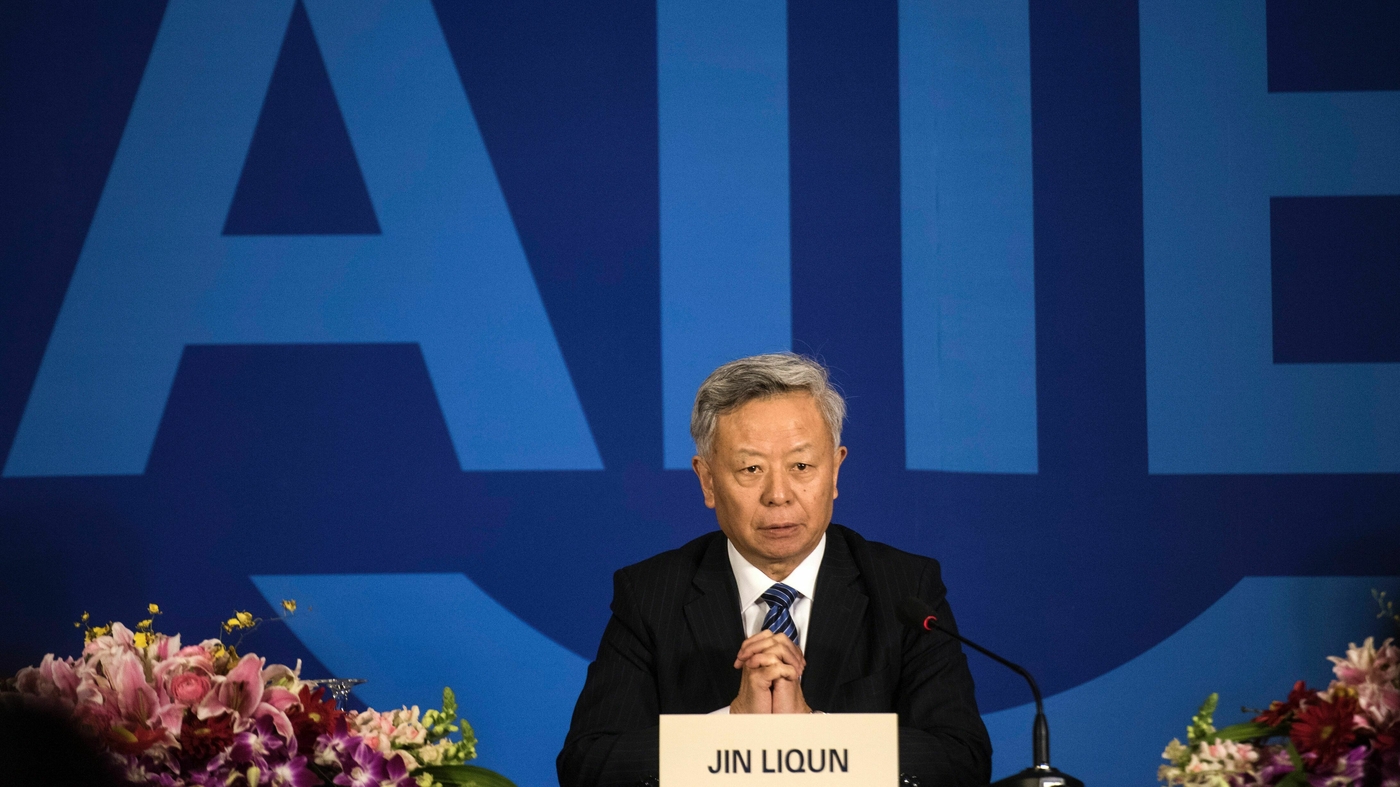

Jin Liqun, AIIB’s president, addresses journalists at a Beijing press conference in 2016.

Fred Dufour/AFP via Getty Images

How have the rising geopolitical tensions between the United States and China impacted the Chinese-led Asian Infrastructure Investment Bank (AIIB)? Its president, Jin Liqun, says they are having no impact.

“Regardless of the bilateral issues, which seems to be troubling [between] these two big countries, AIIB has maintained very good, close cooperation with American governmental institutions, financial institutions and respective businesses,” Jin tells NPR’s Steve Inskeep on Morning Edition.

He says the bank has strong relationships with Wall Street companies as well as with the U.S. Treasury Dept.

Contentious issues — from Taiwan, to Chinese spy balloons, to trade — have put both countries on a collision course in recent years. Other financial entities have raised concerns about the growing duopoly between Beijing and Washington.

“Investment funds are particularly sensitive to geopolitical tensions and tend to reduce cross-border allocations, notably to countries with a diverging foreign policy outlook,” according to a recent report by the International Monetary Fund (IMF). In another report, the IMF says, the ongoing tensions between the world’s two largest economies could lead to a 2% decline in global output.

With tensions between the two countries not expected to abate anytime soon, there’s no guarantee that the AIIB won’t be affected in the future, but Jin is confident that his bank has the necessary checks and balances in place to avoid such a scenario.

“We don’t pick projects from the…

Read the full article here

Leave a Reply