New York’s $700 million-a-year tax break for film and TV productions isn’t providing taxpayers with a good return on investment, according to a new analysis commissioned by the state itself.

The state Department of Taxation and Finance quietly released a 359-page report late last month analyzing New York’s major tax incentive programs, which are meant to attract and retain businesses. The analysis, authored by consultant PFM Group, was required by lawmakers two years ago.

The results show a decidedly mixed bag, with some tax breaks — including the state’s marquee Excelsior Jobs Program — performing well, the report found. But the return for the state’s Film Tax Credit, which Gov. Kathy Hochul and lawmakers boosted by $280 million annually last year, was not nearly as positive.

“Based on an objective weighing of the costs and benefits, the film production credit is at best a break-even proposition and more likely a net cost to the state,” according to the report.

For every dollar the state gave in tax breaks from 2018 through 2022, the Film Tax Credit drew an estimated 15 cents in direct tax revenue, the analysis found. When adding indirect and induced jobs — employees who don’t work directly on production but whose employment stems from it — that return rises to 31 cents.

The state Legislature ordered the report as part of the state budget process in 2022, insisting New York hire an independent consultant to examine whether taxpayers are getting a good return.

The resulting report, posted online without fanfare Jan. 31, examined dozens of state tax incentives used to lure businesses to New York or keep them from leaving.

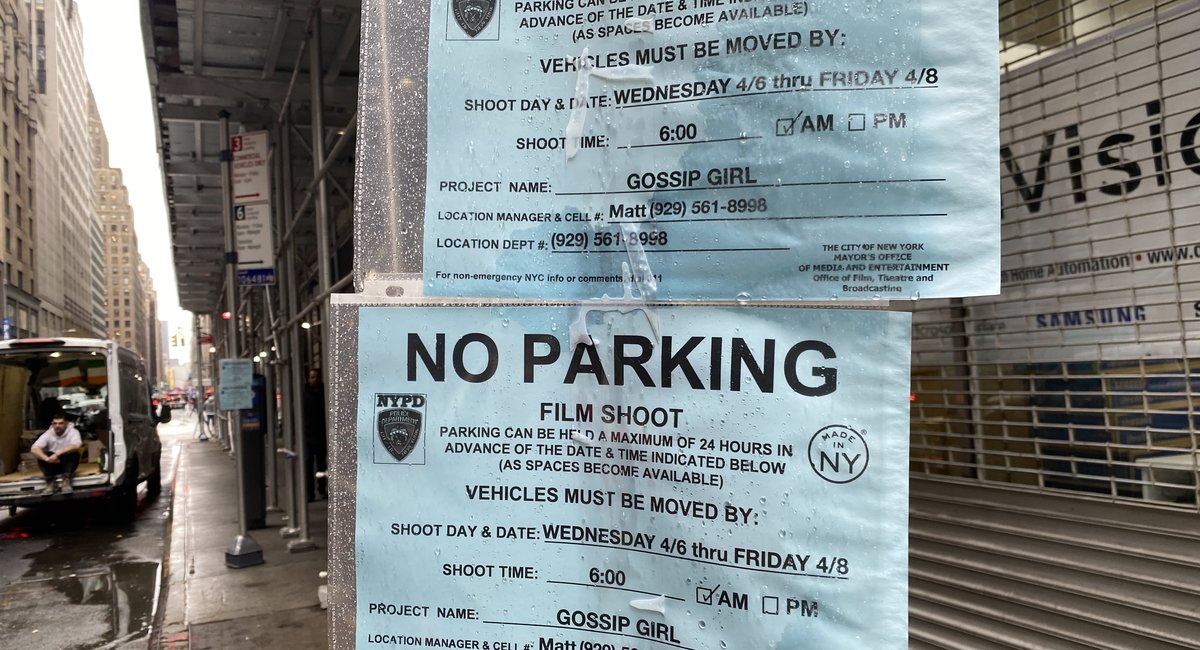

The state’s biggest industry-specific tax break belongs to the film industry, which gets $700 million a year to film or do post-production work in the Empire State. Hochul and legislative leaders are big supporters of the program, which has helped lure hundreds of productions over the years.

The tax break can be considerable. It…

Read the full article here

Leave a Reply