Inflation is down from this time last year, but it is still above 2% – and under New York State law, property tax growth will be capped at 2% next year for local governments starting their fiscal year Jan. 1.

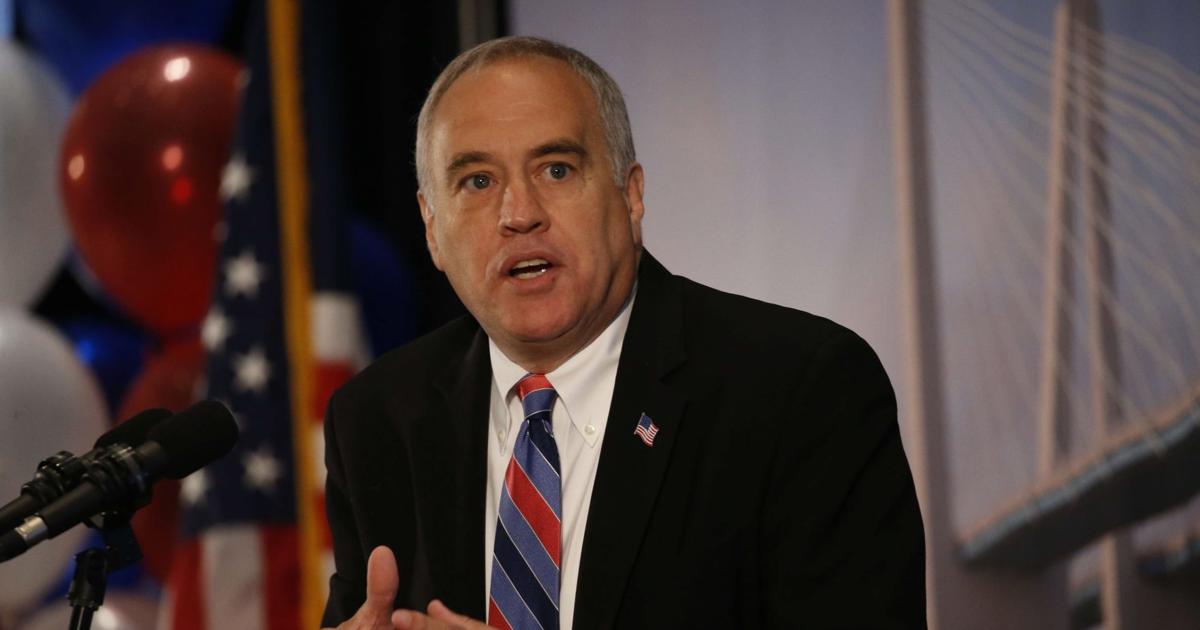

State Comptroller Thomas P. DiNapoli said the cap affects tax levies for all counties, towns and fire districts, 44 cities and 13 villages.

“Allowable tax levy growth will be limited to 2% for a third consecutive year,” DiNapoli said last week in a press release.

“Although the rate of inflation has begun to decrease, it still poses a challenge for local governments and their budgets. As local governments spend down their one-time federal pandemic assistance, officials will need to carefully develop and balance their budgets for the coming year,” he said.

The comptroller’s office calculated the inflation factor for next year at 6.26%, which is above the allowable levy increase.

The tax cap legislation first applied to municipalities in 2012. It limits the increase in the tax levy to the lesser rate of inflation, or 2%, with certain exceptions.

Municipal boards can override the tax cap. School districts, which have a different fiscal year, need 60% of voters to approve a budget with taxes higher than the cap.

The inflation rate in the United States is 3%, compared to 9.1% this time last year.

Read the full article here

Leave a Reply