Had President Biden’s student debt plan survived the U.S. Supreme Court, Derek Smith said his remaining loans would have been “pretty much forgiven.”

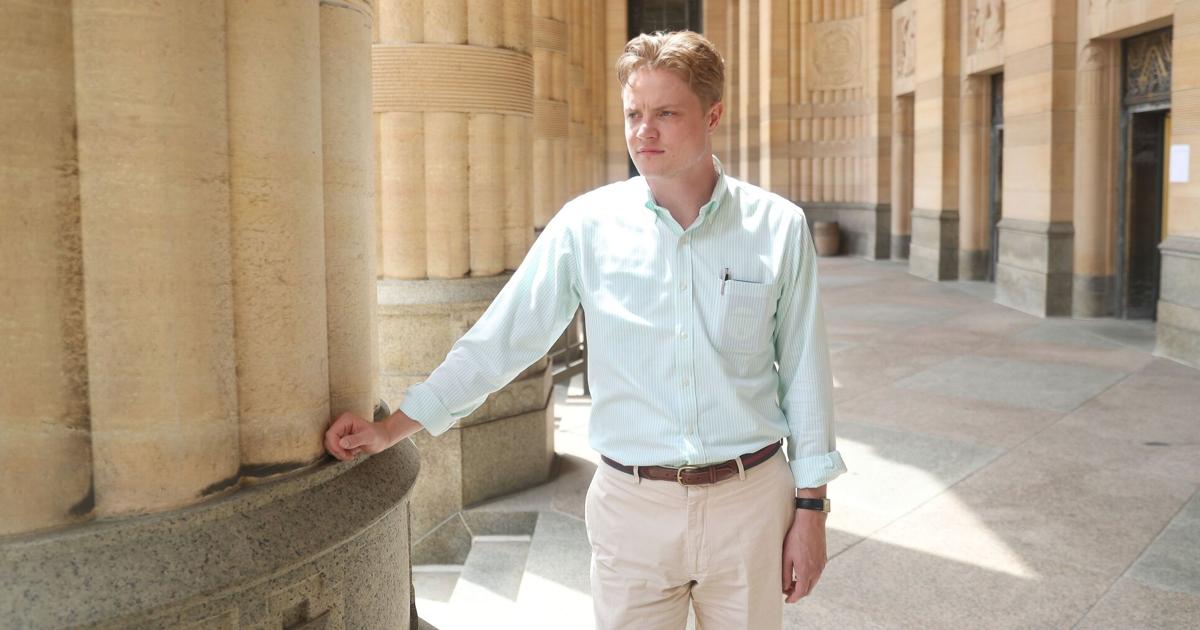

Smith, a 27-year-old senior legislative assistant for the Buffalo Common Council, said he has slightly more than $10,000 in student loans remaining from his undergraduate studies at Jamestown Community College and SUNY Oswego.

But Smith and others who paused making payments will soon have to resume paying off their loans.

“My main concern now is having to start the payments again, because ever since the pandemic, I’ve been a little lax on those,” Smith said. “And then while it was in the Supreme Court, I thought, ‘Well, there’s no point in paying now.’ I just kind of rolled the dice and didn’t pay it.”

Loan payments, which have been paused since the onset of the Covid-19 pandemic in 2020, are set to resume in October.

The impending repayment of student loans will have more of a “psychological effect” on borrowers right now than an economic impact, said Nathan Daun-Barnett, an associate professor of educational leadership and policy at University at Buffalo.

“Most folks haven’t been paying (their loans) for three years,” said Daun-Barnett, whose research focuses on access and equity in higher education. “So, the big shock is going to come in October, when the student loan debts are going to become due again. Some folks are going to feel it then.”

…

Read the full article here

Leave a Reply